RWA drives engagement at the intersection of crypto and TradFi

This year has seen a noticeable increase in blockchain adoption by traditional finance (TradFi). Financial institutions (FI) are catching on to blockchain’s benefits in ways that are bolstering the technology’s image and usage. Whether it is tokenized cash deposits, overnight repurchase agreements, or other financial management strategies for their clients, FIs are leaning into blockchain-based finance more than ever, and real world asset tokenization (RWA) is at the forefront of this movement.

RWA — more than an industry buzz term

While RWA has existed in the blockchain space for several years as digital representations of off-chain assets, it has recently gained significant traction with more traditional asset classes. To be clear, RWA in blockchain is not related to the more conventional “RWA” acronym meaning “risk weighted assets,” or a bank’s off-balance sheet exposures weighted by risk. Rather, RWA has taken on its own meaning in the blockchain industry recently and has been a catalyst for network usage and digital asset adoption this year.

Perhaps Sarah Green, Law Commissioner for Commercial and Common Law at Law Commission of England and Wales, puts it best in speaking with XDC Foundation Executive Director, Billy Sebell:

RWAs are an object lesson in the genius and power of the blockchain. In crossing both legal and technological frontiers, they have the potential to invigorate TradFi and provide highly attractive new investment opportunities.

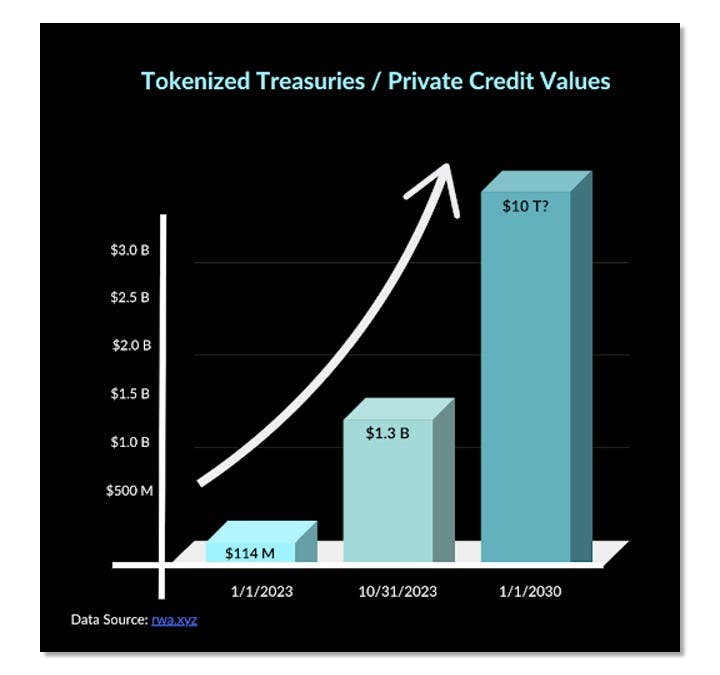

XDC Foundation sees a bright future for RWA. 21.co reports that projected growth in the RWA category could achieve $10 trillion in favorable market conditions by 2030, up from $118 billion today. The signs are there. In the current bear market, tokenized private credit and U.S. Treasuries have already grown to $1.3 billion (RWA.xyz).

The race is on among financial institutions to launch a tokenized version of a well-oiled U.S. Treasury product or other investment vehicle. And why not? Tokenization on the blockchain provides increased accessibility and fluid connection to traditional products with higher yield.

Similar to how cryptocurrency allows the movement of capital or value over the internet, tokenization in theory could allow for exchanging assets over the internet without relying on centralized third parties and common restrictions such as operating hours, hefty fees, and constricted platforms. In addition, assets can be traded between different applications — a commodity in a futures contract can become the item tracked in a supply chain smart contract through the entire supply chain cycle, for example. In short, more parties can engage in trade directly with each other.

The early days of tokenization laid the groundwork for an enriched set of TradFi offerings

Innovation has always been the hallmark of tokenization. NFTs have been around for nine years, and 2017 saw a new level of creativity with the introduction of CryptoKitties, a cat collectibles trading game launched on Ethereum. From there the NFT market soared with enthusiasm and market capitalization. Since inception, nearly 70 million NFTs have traded for over $61 billion (CoinMarketCap).

While NFTs like the Bored Ape collection or the $69 million Beeple JPEG may not appeal to traditional vanguards, these and other hyped-up tokens pioneered a process that leverages the backbone of blockchain technology — smart contracts. NFTs are simply a form of tokenization that uses smart contracts to digitize a tangible or intangible asset on the blockchain. FIs and fintechs are now beginning to leverage smart contract capabilities in creative ways to streamline processes and tap into new markets.

For instance, Tradeteq, the London-based marketplace for private credit and provider of securitization-as-a-service, has real world experience in RWA through innovative solutions that follow unique trade finance standards.

This year, through their subsidiary Yieldteq, Tradeteq issued the USTY token on the XDC Network. USTY gives investors exposure to a multibillion-dollar, highly liquid ETF that is indexed to short-term U.S. government bonds. The tokens are issued through digital securities provider Securitize. This important milestone offers a further proof point in RWA, not just through the advantages of blockchain technology, but also by leveraging the power of traditional investment classes.

RWA Tokenization favors market participants in many ways

Interest in cryptocurrency technology precedes this recent RWA movement. Now, with trusted FIs providing access to digital assets that are backed by or tied to real world assets, traditional investors can participate in the new technology at risk levels they are accustomed to.

Blockchain technology offers both retail and institutional participants some interesting capabilities — 24/7 trading access, smaller trades, liquidity, low overhead — which, in turn, may enable higher yields and more investment opportunities. A tokenized asset tied to an existing multibillion-dollar ETF may provide a level of access and liquidity — as well as a more easily diversified portfolio — not readily achieved in TradFi. Likewise, tokenized real world assets give participants in the blockchain industry a way to diversify their investment portfolios. With RWAs on chain, investors can opt out of crypto-native instruments, such as stablecoins that are required to maintain a peg, in favor of traditional financial instruments that still leverage the technology, such as tokenized treasuries.

While tokenization itself may be a challenging concept to industry newcomers, it is a simple process. In many ways, tokenization reflects digitization in the 1990s, when documents and other forms of information transformed from physical files into data hosted on a computer. Today’s tokenization process is similar in that a token holds a reference to a document or other form of information that can be managed on a shared database called the blockchain.

RWA and its impact on spot bitcoin ETFs

The world waits in anticipation for the Securities and Exchange Commission to approve the first spot bitcoin ETF in the U.S. The possibility exists, of course, that market capitalization of the spot ETFs will quickly exceed that of RWA — providing another strong indicator of TradFi’s increased valuation of blockchain-based instruments.

Does it matter if the onset of spot bitcoin ETFs slows the pace of RWA? Or vice versa, could RWA reshape the juggernaut of a cryptocurrency ETF? It will be interesting to see what effect, if any, ETFs have on the trajectory of RWA tokenization. Regardless, FIs are becoming increasingly more comfortable with blockchain technology and are beginning to capitalize on its benefits.

As the pace picks up on the RWA movement, blockchain utility swells in recognition

Blockchain technology is more than the engine supporting crypto. If TradFi’s adoption of RWA helps expose the virtues of blockchain, it may lead to escalating adoption across more industries. Real estate, for example, is another industry that utilizes blockchain prominently. RWA allows investors to own property through fractional ownership where one smart contract provides ownership opportunities for multiple investors.

RWA will likely not be the only big mover in crypto’s convergence with TradFi. Data tokenization has the potential for major impacts on financial institutions. While certain modernization exists through the demands of their regulators, FI legacy processes can dream of the benefits that putting data on the blockchain will achieve.

As RWA brings an increased level of confidence in blockchain technology, adoption use cases will expand in scope and variety as well.