In a post dated March 27, 2023, trade finance expert André Casterman described the Trade Finance Distribution Initiative’s (TFDi) evolving trade distribution blueprint and “calibrated” its initial focus established in 2019. During a day-long summit in London in early 2023, TFDi once again brought together bank representatives and industry leaders to debate the evolution and direction of trade distribution.

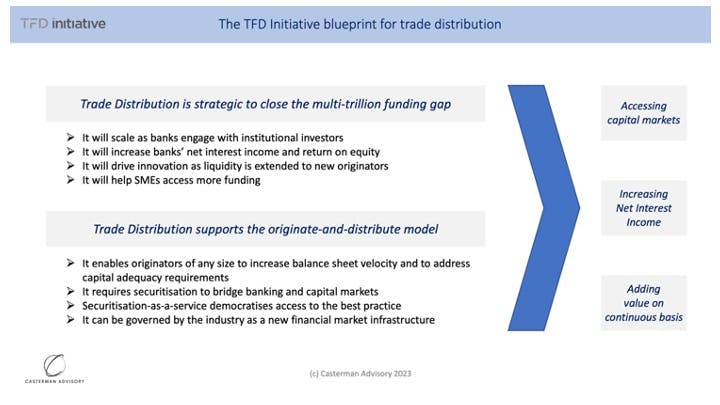

The trade distribution blueprint is designed to help banks achieve three things:

Accessing capital markets

Increasing net income

Adding value to transaction as needs evolve

While the panel provided meaningful insights from the origination and investor perspectives, the meeting itself was a compelling tale of the efforts to make the trade finance asset class available to new investor groups. This long-held establishment by large commercial banks needs an expanded secondary market, and institutional investors are the obvious target for this with retail investors in line to benefit as well. By expanding the trade finance asset class in this way, the trade finance gap will be addressed and ultimately reduced through more capital being made available to SMEs.

Outlined in its original meeting four years ago, the TFDi group re-emphasized the need for an expanded trade finance originate and distribute model — a model that has historically been limited to inter-bank risk sharing. With an emphasis on digitization and standardization, this expanded version will provide a solid foundation for a greater secondary market and will, in turn, provide increased capital through a more robust trade finance cycle.

How can expanded trade distribution be achieved?

A common strategy discussed at both meetings is technology’s role in achieving the desired outcomes for expanded distribution in trade finance. As discussed in both the 2019 and 2023 TFDi debates, blockchain technology offers an unprecedented opportunity to achieve these goals. It is the bedrock for the technological capabilities, known and unknown, for a wider distribution of trade finance assets.

Blockchain technology, and specifically the XDC Network, has already shown that the technology can be adopted for trade finance-specific use cases. Global Trade Review reported on the first trade finance NFT transaction in 2021 created by trade finance technology specialist Tradeteq and launched on the XDC Network, a Layer 1 EVM-compatible, decentralized blockchain. Digitally represented by an NFT, the packaged trade finance assets became available to a wider investor audience and proved there was a channel for an expanded distribution model.

Then in 2022, through its subsidiary XDCTEQ, Tradeteq created TRADA Tokens — fully regulated tokens that represent trade finance assets as fungible security tokens. Also launched on the XDC Network, the security tokens created further investor opportunities through an accessible, scalable, and secure blockchain solution.

Noting that accessibility is a key component in an expanded originate and distribute trade finance model, what if there was a platform that gave secondary markets access to fully regulated trade finance assets as an investment class?

Securitization-as-a-Service (SaaS) could be the all-in-one solution to ramp up trade finance distribution in a meaningful way. Pointed out at the recent TFDi debate, there are already various platforms and portals that support global trade and receivables financing on the origination side of the model. However, there are few solutions on the distribution side, and most of those focus on the financial institution (FI) risk model.

Clients expect end-to-end digital experiences starting with sourcing through a marketplace, onboarding digitally, transacting digitally and automating as many deal execution and reporting processes as possible.

SaaS is poised to make a significant impact on the originate-and-distribute chain. Banks will be able to originate more trade finance volume as both institutional and retail investors boost the secondary market through increased participation. The group concluded that SaaS will be necessary to bridge the gap between banking (origination) and capital markets (distribution). Further, SaaS will democratize access to originate and distribute best practices.

Digitising FI-to-FI distribution is interesting but will not move the needle. Securitisation is required to transform trade assets into notes, or tokens, as expected by institutional investors.

The XDC Network will provide a prime technological base upon which SaaS can be built. The enterprise-ready blockchain and its low cost transactions, high speed throughput, and high-grade security can be leveraged to scale up the trade distribution process.

Observations and Questions

As pointed out at the TFDi debates, there are some important observations and questions to be answered as the trade distribution blueprint continues to evolve:

A distribution marketplace is needed to avoid bilateral distribution methods.

Will banks coordinate with each other to standardize an expanded originate-and-distribute model?

More originators and investors are being added. Will banks work together to scale the distribution market?

Investor education is important as trade finance receivables securitization is quite different from supply chain finance programs.

Promoting the product correctly is essential in trade distribution success.

These TFDi debates show that there is already an appetite in the secondary market for expanded trade distribution. The front-end technology and user experience will be reinforced by the efforts underway to digitize and standardize the process.

Check back here for a review of the Industry Blueprint for Digital Negotiable Instruments.